Page for parents and study participants

There are many events in life that can make parents feel insecure about their finances. For example, becoming unemployed, falling ill or having a baby. Everyone can feel anxious and stressed about their finances at some point in their life, and everyone can benefit from the help of an advisor from time to time. If you are interested in getting support with your finances, help is available.

The purpose of the study is to test a new approach where you as a parent can answer questions about your finances during your family's visit to child health care. If you feel that something is difficult with your finances, or you are worried that it will become more difficult in the future, you can get help. Through Healthier Wealthier Families, you can get in touch with a budget and debt counsellor in your home municipality. The counselling is free, so it doesn't cost any money to contact them. They also have confidentiality, which means that what you talk about in the counselling will not be disclosed to anyone else.

The aim of the study is to reduce the number of families with children experiencing financial difficulties.

Budget and debt counselling are services available in all municipalities. A budget and debt counsellor can, among other things, help people to:

- Planning for their finances and creating a budget

- Help with managing and clearing debts

- Helping to apply for various forms of financial support

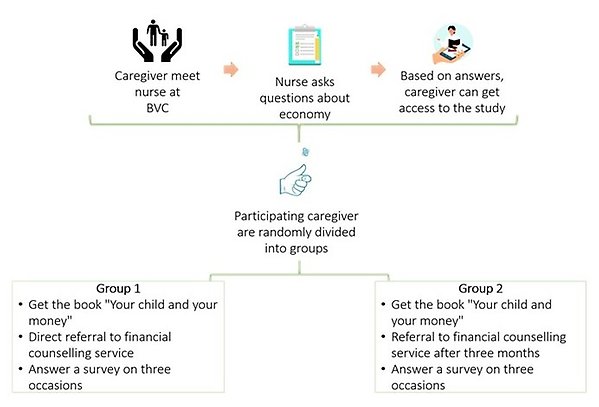

As a participant in the study, you will have to answer a questionnaire about your finances and health on 3 occasions. When you agree to the study, after 3 months and after 12 months. This is to see if the counselling has been helpful to you and your family.

After that, you will be randomly assigned to a group. One group will be referred to the budget and debt advice service immediately, the other group will be referred to the budget and debt advice service 3 months later. All parents will receive a book on parenting and finances. The book is called "Your child and your money" and will be distributed at the BVC. For the digital book, click here.

The study divides participants into two groups to investigate whether there might be a difference between receiving an information book and being referred to a financial advisor directly, compared to the group that starts working on their finances on their own first and then meets a financial advisor. You can see how this works in the figure:

Process to randomise the parent groups